Modernize Your Space Bungalow Kitchen Remodel Ideas

Embracing Modernity in Bungalow Kitchen Remodeling When it comes to renovating a bungalow kitchen, the goal is to strike the perfect balance between preserving its charming character and introducing modern…

Discover the Charm of Village Gardens Cozy and Picturesque

The Enchantment of Village Gardens Nestled amidst the quaint streets and historic charm of village life, village gardens offer a unique glimpse into a world of tranquility and beauty. These…

Elevate Your Space Stylish Modern Apartment Design

Embracing Modern Apartment Living In the bustling cityscape, modern apartment design offers a haven of style and functionality. Whether you’re a busy professional seeking a sleek urban retreat or a…

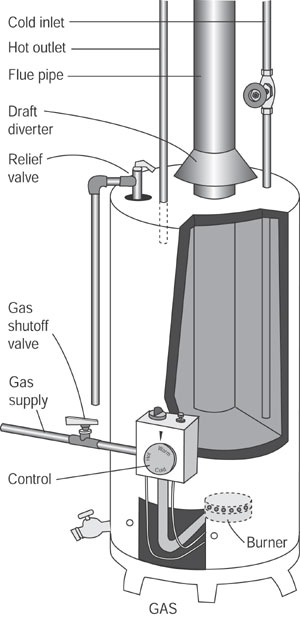

Expert City Gas Water Heater Repair Services Near You

The Importance of a Reliable Water Heater In the chill of winter or the early morning rush, a functioning water heater is a household essential. When your city gas water…

Essential Building Repairs Keeping Your Property Strong

The Foundation of Your Home’s Strength Building repairs are not just about aesthetics; they are essential for the structural integrity of your property. From the foundation to the roof, every…

Rustic Charm Wooden Interior Design Ideas for Your Home

Rustic Charm Wooden Interior Design Ideas for Your Home Wood has a way of bringing warmth and character into any space, creating a cozy and inviting atmosphere. If you’re looking…

Explore Local House Refurbishment Companies Near Me

Explore Local House Refurbishment Companies Near Me In the quest to transform your house into a dream home, finding the right refurbishment company can make all the difference. With a…

The Handyman Chronicles Tales of a Home Repair Man

In the world of home repairs, there exists a hero in everyday attire – the home repair man. Let’s delve into the fascinating tales of their handy work, as they…

Revamp Your Space Major Home Renovations for Modern Living

Revamp Your Space: Major Home Renovations for Modern Living In the realm of home improvement, there comes a time when a mere touch-up or minor upgrade just won’t cut it.…

Owens Corning Driftwood Timeless Elegance for Your Roof

Discover the Timeless Beauty When it comes to choosing roofing materials, homeowners seek not only durability but also aesthetic appeal. Owens Corning Driftwood shingles offer a blend of both, bringing…