Service provider money advance is a means via which a business can get money move against its credit and debit card funds. Rates of interest are capped at 9.75%—which is decrease than a brand new entrepreneur could find elsewhere—with loan quantities as much as $250,000. To qualify you should have been in business for one 12 months, make a minimum of $8,000 a month in sales and have a minimal private credit score of 580. With an easy availability of loan for business, one can easily establish his own business or renovate his present business.

Service provider money advance is a means via which a business can get money move against its credit and debit card funds. Rates of interest are capped at 9.75%—which is decrease than a brand new entrepreneur could find elsewhere—with loan quantities as much as $250,000. To qualify you should have been in business for one 12 months, make a minimum of $8,000 a month in sales and have a minimal private credit score of 580. With an easy availability of loan for business, one can easily establish his own business or renovate his present business.

Investing in long-time period tools and machinery is important on your business, so we’ve listed some of the finest choices accessible for small business homeowners looking to finance tools. There are no collateral or annual-income requirements, and SnapCap places little emphasis on private credit when determining whether or not to grant a loan. Principally, if you have poor credit score, most business credit lenders would not wish to trouble you by asking you to offer collateral as a form of safety for the loaned cash. The lender approves advances to businesses that have credit scores beneath 500 and makes funds obtainable to debtors inside 72 hours. Rates of interest might end up being the deciding issue for you choosing the loan or not. The Business Backer: The Business Backer makes a speciality of small business financing. These loans are unsecured kinds of loans and therefore you need not mortgage collateral in opposition to it.

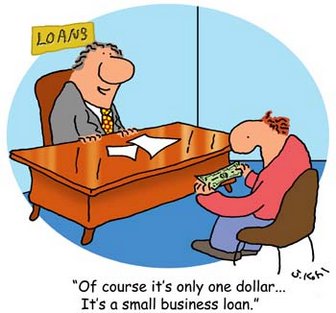

The Small Business Administration’s Workplace of Advocacy additionally reported that loans with a price of $a hundred,000 to $1 million elevated by virtually 32 p.c. Maverick Capital: Maverick Capital is a business funding supplier that offers loans of as much as $250,000 and merchant money advances. Select one of many following links to study more about VA Veteran and Small Business Packages and how VA encourages the involvement of small businesses at the subcontract stage.

Sorts of loans embrace asset-primarily based financing, lines of credit score, alternative loans, gear financing, bridge loans, factoring, time period loans, merchant money advances, SBA loans, working capital, commercial real estate loans, and debt refinance and consolidation.

SBA South Florida District Director Pancho Marrero addressed more than 80 lenders during a Small Business Lender Discussion board on January 26, hosted by the Florida SBDC Network, Florida First Capital Finance Corporation (CDC) and Florida Association of Government Assured Lenders.