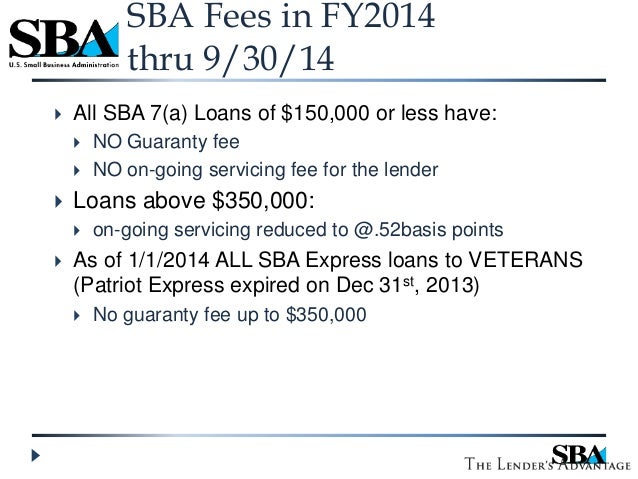

The Small Business Administration has monetary help programs that provide entry to debt and fairness primarily from banks or different non-public sources. SBA’s unique method to inclusive entrepreneurship gives merchandise, services and applications that provide a path to business possession for these populations that additionally endure from disproportionately high ranges of unemployment. An SBA Categorical or 7(a) program mortgage, alternatively, is a business mortgage that splits the risk between the Bank and the SBA, which guarantees a portion of those loans.

The Small Business Administration has monetary help programs that provide entry to debt and fairness primarily from banks or different non-public sources. SBA’s unique method to inclusive entrepreneurship gives merchandise, services and applications that provide a path to business possession for these populations that additionally endure from disproportionately high ranges of unemployment. An SBA Categorical or 7(a) program mortgage, alternatively, is a business mortgage that splits the risk between the Bank and the SBA, which guarantees a portion of those loans.

Private ensures are required of each one that owns 20 percent or extra of the borrowing business. Reimbursement: SBA and the bank anticipate a mortgage to be paid out of the profits of the business. Our SBA Business Growth Officers have broad and various industry expertise building relationships with small businesses. A small business may have multiple SBA mortgage, but the SBA’s share can not exceed $2 million.

When a small business is awarded a authorities contract, the small business is usually capable of quickly create jobs and spur financial growth. All loans subject to SBA, collateral and underwriting necessities, and approval, including credit approval.

With SNHU’s BS in Business Administration – Small Business diploma online, you’ll gain the essential business information it’s essential to start or successfully manage a small business, together with budgeting, funding, operations and writing a business plan. President Barack Obama and his administration have continually supported the SBA and stay backers of a considerable price range allotment for the company. The Program for Funding in Micro-Entrepreneurs (PRIME) gives grants to help low-income entrepreneurs gain financial backing to determine and develop their small businesses.

This system offers small, brief-term loans to small businesses and sure varieties of nonprofit baby care centers. SBA loans, as 7(a) loans are additionally known, are the federal agency’s hottest sort of financing, however they’re not the only loans accessible. The Administration and SBA continue to extend efforts and collaboration to supply more alternatives for small businesses to compete for and win federal contracts. Lender participation is important to progress within the amount of loans authorized and small businesses assisted.