Scene one: you might be perched in your office work area encompassed with paperwork and work over-burden, you’re completely dissatisfied. The rationale why such kinds of loan arrangements had been devised by financial institutions is as a result of the general public who’re searching for financing from such business credit score lenders have got poor or somewhat no credit score rankings. The variety of small businesses started by women has grown at a price faster 5 instances quicker than the nationwide average since 2007.

Scene one: you might be perched in your office work area encompassed with paperwork and work over-burden, you’re completely dissatisfied. The rationale why such kinds of loan arrangements had been devised by financial institutions is as a result of the general public who’re searching for financing from such business credit score lenders have got poor or somewhat no credit score rankings. The variety of small businesses started by women has grown at a price faster 5 instances quicker than the nationwide average since 2007.

The lender offers a variety of mortgage sorts, together with working-capital loans, business growth/acquisition loans, SBA loans, traces of credit, tools financing, inventory financing, accounts receivable factoring and merchant money advances.

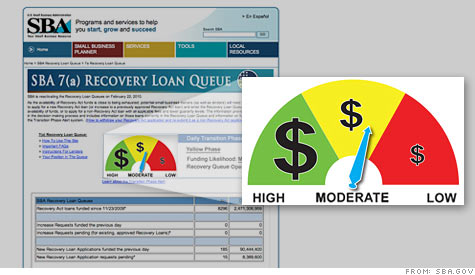

As Administrator of the SBA, McMahon will direct a federal company with more than 2,000 full-time staff, with a leading position in serving to small business homeowners and entrepreneurs secure financing, technical help and coaching, and federal contracts.

Some are overcome by hard work, grit and dedication, some by expertise, and some, whether we care to confess it as business owners or not, by simple dumb luck. North Carolina, South Carolina, Florida and Virginia had been devastated by flood waters and high winds. Business loan rates of interest are usually based mostly on the number of years you’ve got been in business, your private credit score score, the variety of years in which you’ve turned a profit, and the size of the mortgage taken. The NEC hosts several of SBA’s resource and group companions in Central Florida.

There are many organizations out there offering loans for business A lot of the weak credit loan services that you’d come throughout today are in essence obtainable on the internet. Small business loans will be helpful in navigating the unexpected, providing a lifeline to a business on the sting of failure or providing a springboard for these on the sting of success. In the desk beneath, we summarize our picks for the very best small business loans for different needs and forms of entrepreneurs and business owners. However Indian banks are at all times prepared to assist these people by offering them loan for business.