Banc of California’s Small Business Administration (SBA) lending gives expertise in all SBA lending programs. The decline in entry to business improvement creates a rise in the number of companies which can be terminated every year as a result of they do not stay related to the SBA and do not meet program requirements for annual opinions. To be eligible, a business should have been in operation for not less than 1 year and should show that it’s going to enhance export gross sales, or begin exporting, on account of the mortgage.

Banc of California’s Small Business Administration (SBA) lending gives expertise in all SBA lending programs. The decline in entry to business improvement creates a rise in the number of companies which can be terminated every year as a result of they do not stay related to the SBA and do not meet program requirements for annual opinions. To be eligible, a business should have been in operation for not less than 1 year and should show that it’s going to enhance export gross sales, or begin exporting, on account of the mortgage.

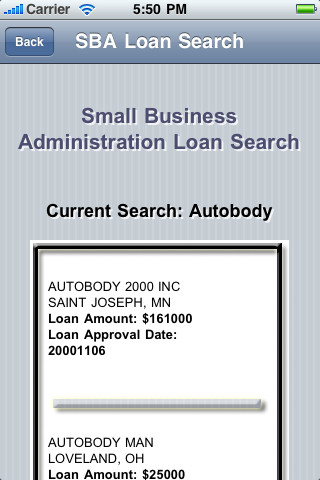

You’ll work with devoted and professional bankers that can offer a mess of particular, customizable services that suit your business operation! Offering access to capital has been one of the SBA’s vital methods in assembly its objective to drive business formation, job growth, and financial growth notably in underserved markets because the Company’s creation in 1953. If a business with a Disaster Relief Loan defaults on the loan, and the business is closed, the SBA will pursue the business owner to liquidate all private belongings, to satisfy an excellent steadiness. SBA loans are small-business loans assured by the SBA and issued by participating lenders, principally banks.

The SBA licenses, regulates and offers financial help to privately owned and operated Small Business Investment Corporations (SBICs) whose major operate is to make venture investments by supplying fairness capital and lengthening unsecured loans and loans not absolutely collateralized to small enterprises which meet their investment standards.

Whereas the government strives to stability affordability with opportunity, SBA engages with companies to continue to promote broader aggressive alternatives to make sure the health of the small business industrial base will not be adversely affected attributable to strategic sourcing or consolidating necessities and to protect small business from contract bundling.

Easing this financial institution lending rule could spur small business progress Banks with experience in a sector are good judges of danger Regulatory strain on banks to gather extra documentation from debtors could be onerous for small firms, writes Andrew Sutherland.